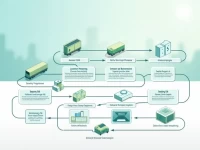

Single Windows Streamline Global Trade with Data Harmonization

This paper provides a brief overview of the Single Window and Data Harmonization concepts, emphasizing their role in improving trade efficiency and reducing costs. It highlights how these initiatives streamline processes and facilitate seamless data exchange between stakeholders involved in international trade. The paper also touches upon the importance of the WCO Data Model as a foundation for data harmonization efforts. Furthermore, it looks ahead to future trends and developments in the field, suggesting potential areas for further research and implementation to maximize the benefits of these initiatives.